General information

US tax return

If you are a US citizen or a green card holder, you have an annual obligation to declare all your worldwide income in America. In most other countries, it is common practice that tax returns are only filed in the country where one lives and works. This is not the case for Americans. When you live or work outside the United States, you must still declare your income in the US. That does not automatically mean that you have to pay. The United States has tax treaties with many countries, stipulating which country may tax which income.

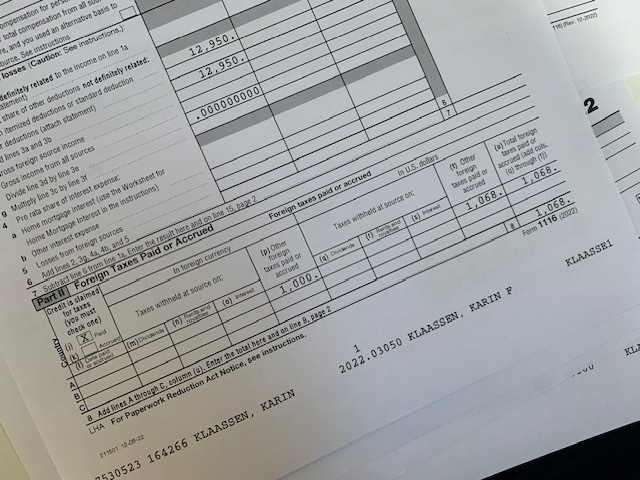

The US reporting obligation consists of two separate reports. The most important report is the tax return (Form 1040) if you have income. If the income from employment exceeds a certain threshold, you must file a tax return in the United States. This threshold is higher every year and is called the standard deduction. For 2022, this threshold is $12,950.00.

If you are not employed, but self-employed (ZZP'er or self-employed), the threshold is much lower. With an income of just $400.00, you must file a tax return in the US.

If you receive income (or have losses) from assets, such as interest and dividends, or from the sale of shares or crypto currencies, this must also be included in the US tax return.

FBAR

The second obligatory report is more complex to explain. In the past, money was channeled from America to foreign countries. The income on those foreign accounts remained hidden from the IRS. The US then decided that they wanted to know from all Americans whether they have any foreign accounts abroad. This duty to report has been put into effect by the passing of the FATCA legislation. Almost all countries have agreed to the FATCA ruling. They now report the accounts of US citizens to a special organization called Fincen.

Nowadays, every American is required to declare all non-US accounts to FINCEN. This reporting of foreign accounts must be done through the Foreign Bank and Financial Accounts Report (the FBAR). The FBAR is only a reporting obligation and does not lead to taxation. The FBAR must be submitted every year, listing all accounts to which one has access and reporting the highest amount held in each account during the year.

Streamlined Foreign Offshore procedure (amnesty procedure)

The Streamlined Foreign Offshore procedure (SFO) has been rigged by the IRS so that citizens who have never filed a tax return before, or have forgotten to do so for a while, can become compliant without the risk of a fine. Therefore, with the SFO, you can file your tax returns and FBARs with the US tax authorities without any problems. However, it is a complex procedure that must be followed correctly, and is something I can prepare for you.

Within the SFO procedure, you must report all your worldwide income and all your foreign bank accounts. The SFO consists of 3 years of reporting your income through a US tax return, and 6 years of reporting the value in your foreign, non-US bank accounts (FBAR). These reports must be submitted together with a statement that you did not deliberately fail to file your US returns.

Once you have followed this procedure, you have become compliant. From that moment on, you must file a US tax return with your income every year and submit your FBAR.

To be able to submit the SFO procedure, you need a social security number.

Relief Procedures for Certain Former Citizens

If you do not have a social security number (SSN) and you want to lose your American nationality, you can do so without an SSN. To this end, a special arrangement has been created by the IRS, the so-called Relief Procedures for Certain Former Citizens.

It is important to know that this is subject to a number of conditions. I can explain this in a telephone appointment. For the Relief Procedure, you must first renounce your American nationality before submitting the final declarations. This is only possible if you have a different nationality, for example, if you are also Dutch or Canadian. This can be a nationality that you received by birth or naturalization.

Dutch tax return

If you live and work in the Netherlands, the Netherlands usually has the right to tax you on your income and assets. To this end, you must file a tax return in the Netherlands even if you do not receive an invitation from the Dutch tax authorities. This also applies if you have a foreign employer or clients as a self-employed individual. If you are employed by an American company but you reside in the Netherlands, you probably must pay tax in the Netherlands. You can claim avoidance of double taxation in the American tax return.

Avoidance of double taxation

There are two ways in which you can avoid paying tax in two countries as an employee or self-employed person. Unfortunately, you are not allowed to choose in which country you pay your income tax. Most countries have a tax treaty in place that determines which country has the right to tax you on your income. Nevertheless, you still need to report your income in the US. If you live, work and pay taxes in the Netherlands or another country, the United States has two rules for avoiding double taxation.

- Foreign earned income exclusion

The first method is easy. Up to an amount of $ 112,000 gross income, you may exclude from taxation in America. That income must be earned through work. Quite simple!

- Foreign tax credit

The second method is more difficult. I will first check the amount of tax you have paid in the Netherlands or another country on your income (box 1). I will convert that to dollars with the exchange rate provided by the IRS. In the US tax return, I may then set off the American tax against the Dutch tax. In most cases, the Dutch tax rate is usually higher than the American rate. In most situations, you will not have to pay income tax in America.

Passive income

In the US, they do not have a box 3 tax (on assets), but they look at the actual income from assets (passive income). Do you rent out a house? Do you own shares or receive interest on your bank account? This income has to be reported in the US. If you have a lot of income from assets (so also a lot of assets), you often pay box 3 tax in the Netherlands. You must report this income from assets, and I will then calculate what you have to pay in the US. Fortunately, I can deduct the box 3 tax from the US tax. Sometimes, there is still a small balance that you have to pay in the US, which is annoying, but not always preventable.

Payment to America

If you have a payment obligation to the US government, it is best to transfer money from a US bank account, which is easy to open at online banks such as Wise. The IRS (the US tax agency) does not accept money from foreign accounts. You can also pay by credit card, but often high rates are applied.

Investing in foreign or US accounts

As an American abroad, it is difficult to open an investment account with foreign and US banks. For the foreign banks, this is because these banks have to report you to the State Department, which in turn has to notify the IRS. Most banks simply do not feel like doing this, and so they do not take on Americans as clients. For a US bank account, you need an American address. If you live abroad it will be difficult to open a US account.

Interactive Brokers

However, there is an online bank that was founded in America, Interactive Brokers. If you want to invest with them, you should state that you are American and have a Social Security Number (SSN). They will pass your information on to the IRS and prepare a Form 1099 for you. This form clearly shows the income from your investments. With Form 1099, this income is easy to report on the US tax return.

If you have managed to invest with a Dutch bank, you must ensure that you keep track of these investments. Dutch banks do not keep records for their customers of which shares were purchased, when or at what price. Therefore, they do not report what your profit is, with a first-in/first-out schedule. This information is what the IRS wants to see. You have to keep track of this information yourself. Since this can be difficult to do, I have shared my recommendation of Interactive Brokers. And no, I do not have any shares with Interactive Brokers, and I do not receive any referral fees from them.